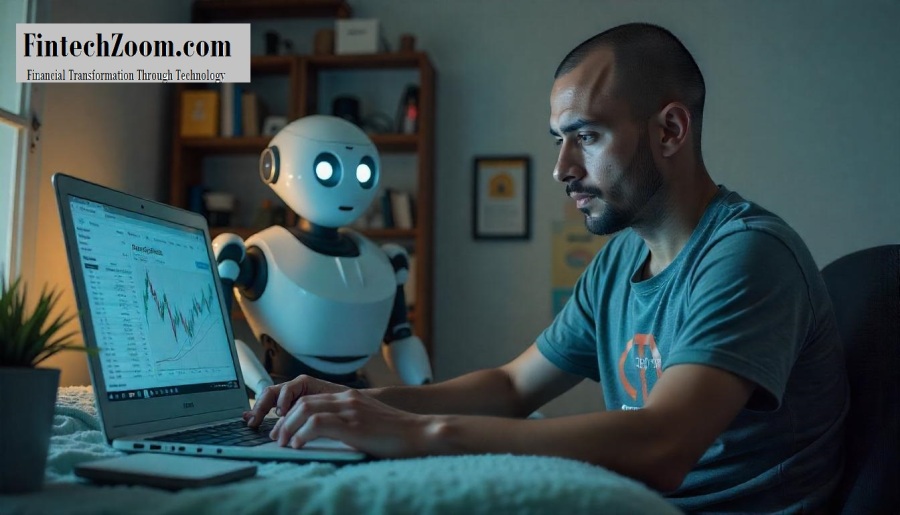

In today’s rapidly evolving financial landscape, digital platforms are reshaping how we interact with money. Among these transformative platforms, fintechzoom.com stands out as a pioneering force. This comprehensive guide explores how this innovative platform is revolutionizing financial services through cutting-edge technology solutions.

The Rise of Digital Finance Solutions

The financial technology sector has experienced unprecedented growth over the past few years. Modern consumers demand seamless, accessible, and secure financial services. Fintech zoom.com has emerged as a response to these evolving needs, providing users with comprehensive financial information and tools at their fingertips.

Financial literacy has become increasingly important in our complex economic environment. Platforms like fintech zoom .com democratize access to financial knowledge, making it available to everyone regardless of their background or expertise level. This accessibility represents a significant shift from traditional financial information channels.

Core Services and Technological Innovations

At its foundation, fintechzoom .com offers a robust suite of services designed to empower users throughout their financial journey. From investment tracking to market analysis, the platform integrates multiple financial tools into one cohesive ecosystem. This integration eliminates the need to navigate between different services, creating a streamlined user experience.

Advanced data analytics forms the backbone of the platform’s capabilities. By leveraging artificial intelligence and machine learning algorithms, the platform provides personalized insights tailored to individual financial situations. These personalized recommendations help users make informed decisions about their investments, savings, and overall financial health.

The cryptocurrency coverage offered by the platform deserves special mention. As digital currencies continue to reshape global finance, fintechzoom.com economy content provides critical analysis and timely updates on market movements. This focus on emerging financial technologies positions the platform at the cutting edge of financial media.

User-Centered Design and Accessibility

Financial information often suffers from complexity and jargon that can intimidate average users. What sets this platform apart is its commitment to making complex financial concepts accessible. Through clear explanations and visualizations, users can grasp sophisticated financial ideas without specialized knowledge.

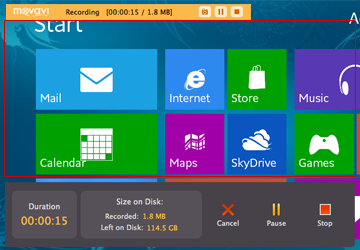

Mobile optimization represents another key strength. The responsive design allows users to access financial information anytime, anywhere. This mobile-first approach acknowledges the changing ways people consume information and manage their finances on the go.

Real-time notifications keep users informed about market developments that may impact their financial decisions. This timely information delivery helps users capitalize on opportunities and mitigate risks in volatile financial markets.

Educational Resources and Community Building

Beyond news and analysis, fintechzoom.com money resources include educational content designed to build financial literacy. From beginner guides to advanced investment strategies, these resources cater to users at every stage of their financial journey. This educational approach transforms the platform from a mere information source into a comprehensive learning tool.

The community aspects of the platform support knowledge sharing within the user base. Forums and discussion boards allow users to exchange insights, strategies, and experiences. This collaborative environment enriches the platform’s value proposition beyond what its developers alone could provide.

Webinars and expert interviews further enhance the educational offerings. These interactive sessions allow users to learn directly from financial professionals, bringing expert-level insights to the general public.

Security Measures and Trust Building

In the financial technology sector, security remains paramount. The platform implements robust encryption and data protection measures to safeguard user information. This security-first approach builds the trust necessary for users to engage confidently with digital financial services.

Transparency in operations further strengthens user trust. Clear policies regarding data usage and privacy demonstrate respect for user concerns in an increasingly data-conscious world. This transparency distinguishes the platform in an industry often criticized for opaque practices.

Regular security updates ensure the platform stays ahead of emerging threats. This proactive approach to cybersecurity reflects the platform’s commitment to maintaining a secure environment for financial information exchange.

Future Directions and Innovations

As financial technology continues to evolve, the platform is positioned to incorporate emerging technologies. Blockchain integration, expanded artificial intelligence capabilities, and enhanced personalization represent just a few potential development areas. These innovations will likely expand the platform’s utility and relevance.

Global market expansion efforts aim to bring these financial tools to more users worldwide. This international outlook acknowledges the increasingly connected nature of global finance and the universal need for accessible financial information.

Conclusion

FintechZoom.com exemplifies how technology can broaden access to financial information and services. By combining user-friendly design with powerful analytical tools, the platform empowers users to take control of their financial futures. As financial technology continues to evolve, platforms like this will play an increasingly central role in shaping how we interact with the economy.

In an era where financial literacy can significantly impact quality of life, such platforms serve as crucial bridges between complex financial systems and everyday users. Their continued innovation promises to further transform how we understand, manage, and grow our financial resources.

Frequently Asked Questions

Q: What makes FintechZoom different from other financial websites?

FintechZoom distinguishes itself through its comprehensive integration of financial news, analysis tools, educational resources, and community features in one platform. Its focus on technology-driven financial transformation also sets it apart from traditional financial information sources.

Q: How can beginners benefit from using FintechZoom?

Beginners gain access to educational content specifically designed to build financial literacy from the ground up. The platform’s user-friendly interface and jargon-free explanations make complex financial concepts accessible to those just starting their financial journey.

Q: Does FintechZoom offer real-time market data?

Yes, the platform provides real-time market updates and notifications on significant financial developments. This timely information helps users make informed decisions guided by current market conditions.

Q: Is FintechZoom available internationally?

FintechZoom serves a global audience with financial information and resources. The platform continues to expand its international coverage to address financial markets worldwide, making it relevant for users across different countries and regions.